Pictured: GFC Director Tim Lowrimore tours Flint River Nursery in Byromville, GA. Left to right: Russell Ayers, GFC Flint River Nursery Coordinator; Ben Cobb, GFC Flint River Nursery Technician; Lowrimore; and Anita Johnson, GFC Arrowhead Seed Orchard Supervisor.

Georgia has approximately 22 million acres of privately owned working forests — more than any other state in the nation. So, naturally, the state also represents the greatest opportunity for the growing forest carbon market. The Georgia Forestry Foundation (GFF) recently launched its Carbon101 Education Initiative to provide landowners who are exploring this market with access to resources and information to make informed decisions for their land.

According to U.S. Forest Service Data, more than 18 million acres of Georgia’s forests are classified as nonindustrial, private forestland. That land is owned by more than 450,000 owners, who range from individuals and families to limited partnerships. As the carbon market continues to grow and gain national and international attention, the Georgia Forestry Association (GFA) identified the Carbon101 education initiative as an opportunity to provide smaller landowners with a baseline understanding of the carbon market, how the market works and what they should expect in the future.

“We received a lot of calls starting in early 2020, as carbon developers started coming to the state and seeking to build relationships with landowners,” said Andres Villegas, president and CEO of GFA and GFF. “For a smaller landowner, it is critical that they fully understand the mechanics of the marketplace before entering a contract. So, we are proud of this initiative and our longer-term efforts to bridge that gap between the landowner community and this emerging market.”

According to U.S. Forest Service Data, more than 18 million acres of Georgia’s forests are classified as nonindustrial, private forestland. That land is owned by more than 450,000 owners, who range from individuals and families to limited partnerships. As the carbon market continues to grow and gain national and international attention, the Georgia Forestry Association (GFA) identified the Carbon101 education initiative as an opportunity to provide smaller landowners with a baseline understanding of the carbon market, how the market works and what they should expect in the future.

“We received a lot of calls starting in early 2020, as carbon developers started coming to the state and seeking to build relationships with landowners,” said Andres Villegas, president and CEO of GFA and GFF. “For a smaller landowner, it is critical that they fully understand the mechanics of the marketplace before entering a contract. So, we are proud of this initiative and our longer-term efforts to bridge that gap between the landowner community and this emerging market.”

A Growing Market

For several years, forests have received increasing national and international attention as scientists, nonprofits, politicians and business leaders have debated and searched for solutions to climate change. That growing recognition has initiated a flood of capital from corporations that are looking to purchase carbon credits to reduce their own carbon emissions.

By 2020, companies such as BP, Microsoft, Amazon, Apple, Delta, Facebook, Google, Starbucks and many more announced that they were going to focus on carbon removal as a key priority in their climate strategies. Forests, re-forestation and conservation initiatives were largely recognized as part of the overall strategy.

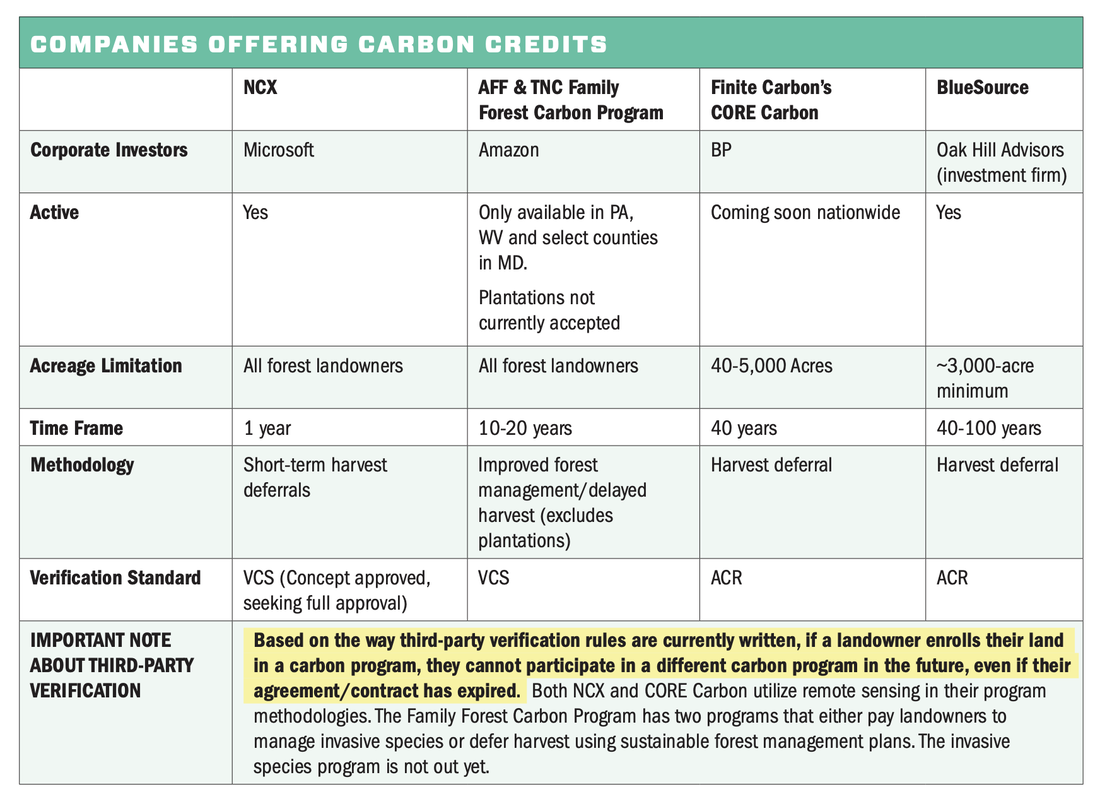

Companies have invested or pledged to spend billions of dollars in securing carbon credits. In response, businesses such as NCX (formerly known as SilviaTerra) and Finite Carbon and nonprofits such as the American Forest Foundation have sought to expand the voluntary carbon offset market to smaller forest landowners — ditching the older, California-style 100-year agreements for shorter agreements that range from one to 30 years.

NCX was one of the first companies to launch a short-term, one-year harvest deferral contract for landowners. The company uses satellite imagery to determine wood volume, tree species and proximity to timber markets. These metrics are then used to determine the carbon potential and value for a given tract. Landowners are compensated for the additional carbon accumulated by agreeing to defer harvest activities for one year.

As an early investor in NCX, Microsoft signed on to buy 200,000 offsets when the company opened its market to forest landowners in 11 Southern states in April of 2021. At $17 per credit, Microsoft’s total investment was $3.4 million. According to NCX, its winter 2022 cycle included nearly 1,800 landowners with a total of 2 million acres across the contiguous United States, stretching across 39 states, including Georgia. Through the three program cycles, NCX has enrolled more than 200 forest landowners in Georgia. In addition to NCX, other carbon developers are making progress launching carbon programs for small landowners.

For several years, forests have received increasing national and international attention as scientists, nonprofits, politicians and business leaders have debated and searched for solutions to climate change. That growing recognition has initiated a flood of capital from corporations that are looking to purchase carbon credits to reduce their own carbon emissions.

By 2020, companies such as BP, Microsoft, Amazon, Apple, Delta, Facebook, Google, Starbucks and many more announced that they were going to focus on carbon removal as a key priority in their climate strategies. Forests, re-forestation and conservation initiatives were largely recognized as part of the overall strategy.

Companies have invested or pledged to spend billions of dollars in securing carbon credits. In response, businesses such as NCX (formerly known as SilviaTerra) and Finite Carbon and nonprofits such as the American Forest Foundation have sought to expand the voluntary carbon offset market to smaller forest landowners — ditching the older, California-style 100-year agreements for shorter agreements that range from one to 30 years.

NCX was one of the first companies to launch a short-term, one-year harvest deferral contract for landowners. The company uses satellite imagery to determine wood volume, tree species and proximity to timber markets. These metrics are then used to determine the carbon potential and value for a given tract. Landowners are compensated for the additional carbon accumulated by agreeing to defer harvest activities for one year.

As an early investor in NCX, Microsoft signed on to buy 200,000 offsets when the company opened its market to forest landowners in 11 Southern states in April of 2021. At $17 per credit, Microsoft’s total investment was $3.4 million. According to NCX, its winter 2022 cycle included nearly 1,800 landowners with a total of 2 million acres across the contiguous United States, stretching across 39 states, including Georgia. Through the three program cycles, NCX has enrolled more than 200 forest landowners in Georgia. In addition to NCX, other carbon developers are making progress launching carbon programs for small landowners.

Backed by a major investment from BP, Finite Carbon’s CORE Carbon program, which is designed for smaller landowners between 40 and 5,000 acres, received approval of its methodology from the American Carbon Registry in November 2021, and the company will begin accepting applications soon from interested landowners. Similar to NCX, CORE Carbon will utilize remote sensing technology; however, it will use this technology to quantify emissions reductions from harvest deferrals on non-industrial private forests.

In October 2020, the Family Forest Carbon Program, developed by The Nature Conservancy and American Forest Foundation with a $10 million investment from Amazon, opened enrollment for small landowners in Pennsylvania, all of West Virginia and five counties in western Maryland. The program is expected to continue expanding its coverage areas into the Southeast and the Lake States.

The Family Forest Carbon Program differs from other developers and will offer two program types. Both programs will provide landowners with expertise and management plans, but one program focuses on funding for forest management activities to combat invasive species and vegetative competition for young forests. The other program focuses on deferring harvest and growing timber for longer.

Building A Knowledge Base

The carbon offset market is complicated, and, seemingly overnight, Georgia landowners — both large and small — were given the opportunity to participate. However, there was no single organization, outside of carbon developers like NCX and academic institutions, who could provide landowners with a baseline of knowledge needed to make smart business decisions. Carbon101 is aimed at answering a variety of complicated questions, including:

● What is additionality, permanence and leakage?

● What are the types of carbon offset projects?

● What is the difference between carbon offset and carbon storage?

● Who are the main companies offering carbon agreements?

● What are the main verification standards and why are they important?

● How will these agreements impact my ability to manage my land?

● How is state and federal policy influencing carbon markets?

In addition to providing a sound source of information on the topics above, GFF plans to expand content to include videos with forest carbon experts to tackle big questions in an easy-to-understand way. Also, users can find a clearinghouse of news related to carbon market developments in the U.S.

“Our aim is to be a one-stop shop for information on entering carbon offset agreements,” GFA Director of Membership Tim Miller said. “Rather than digging through academic journals and sorting information from carbon developers, landowners can come to one place to find the most up-to-date information.”

Miller, who has a Master of Forest Resources degree from the University of Georgia, and GFF Vice President Nick DiLuzio, who has a Master of Forestry degree from Duke University, researched and compiled the information for this project. ■

Matt Hestad is the vice president of engagement for the Georgia Forestry Association.

In October 2020, the Family Forest Carbon Program, developed by The Nature Conservancy and American Forest Foundation with a $10 million investment from Amazon, opened enrollment for small landowners in Pennsylvania, all of West Virginia and five counties in western Maryland. The program is expected to continue expanding its coverage areas into the Southeast and the Lake States.

The Family Forest Carbon Program differs from other developers and will offer two program types. Both programs will provide landowners with expertise and management plans, but one program focuses on funding for forest management activities to combat invasive species and vegetative competition for young forests. The other program focuses on deferring harvest and growing timber for longer.

Building A Knowledge Base

The carbon offset market is complicated, and, seemingly overnight, Georgia landowners — both large and small — were given the opportunity to participate. However, there was no single organization, outside of carbon developers like NCX and academic institutions, who could provide landowners with a baseline of knowledge needed to make smart business decisions. Carbon101 is aimed at answering a variety of complicated questions, including:

● What is additionality, permanence and leakage?

● What are the types of carbon offset projects?

● What is the difference between carbon offset and carbon storage?

● Who are the main companies offering carbon agreements?

● What are the main verification standards and why are they important?

● How will these agreements impact my ability to manage my land?

● How is state and federal policy influencing carbon markets?

In addition to providing a sound source of information on the topics above, GFF plans to expand content to include videos with forest carbon experts to tackle big questions in an easy-to-understand way. Also, users can find a clearinghouse of news related to carbon market developments in the U.S.

“Our aim is to be a one-stop shop for information on entering carbon offset agreements,” GFA Director of Membership Tim Miller said. “Rather than digging through academic journals and sorting information from carbon developers, landowners can come to one place to find the most up-to-date information.”

Miller, who has a Master of Forest Resources degree from the University of Georgia, and GFF Vice President Nick DiLuzio, who has a Master of Forestry degree from Duke University, researched and compiled the information for this project. ■

Matt Hestad is the vice president of engagement for the Georgia Forestry Association.

|

Georgia Forestry Magazine is published by HL Strategy, an integrated marketing and communications firm focused on our nation's biggest challenges and opportunities. Learn more at hlstrategy.com

|