The South is Growing Again

All (Timber) Roads Lead to the Southeast

By Patty Deutsche

Winter 2022

GFC Bleckley/Pulaski Chief Ranger David Brown discusses outdoor burn notification changes with landowner George Grimsley in Hawkinsville, GA.

GFC Bleckley/Pulaski Chief Ranger David Brown discusses outdoor burn notification changes with landowner George Grimsley in Hawkinsville, GA.

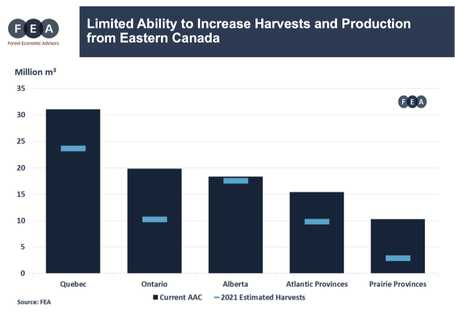

“We have already seen remarkable growth in the South’s forest product sector, and given the region’s supply of well-managed softwood timber, it remains well-positioned to take advantage of increasing demand in both domestic and international markets.”

– Rocky Goodnow, VP, Timber, Forest Economic Advisors

Photo Credit: Stephen B. Morton

Photo Credit: Stephen B. Morton

|

Georgia Forestry Magazine is published by HL Strategy, an integrated marketing and communications firm focused on our nation's biggest challenges and opportunities. Learn more at hlstrategy.com

|